Matthew Bogobowicz • 3 Mins Read • July 29, 2024

How Contract Privity Affects Additional Insured Endorsements

Recently, a New York appellate court shockingly ruled that certain language commonly used on Additional Insured forms doesn’t cover all parties because of a legal concept called contract privity. The result of the ruling was that a property owner was found to not be covered by a subcontractor’s insurance because the owner’s contract was with the General Contractor, not the sub.

The lesson here is clear: when it comes to commercial liability insurance, what you don't know about contract privity could cost you dearly.

"Contract privity" is a term that means only the people or groups specifically mentioned in a contract have the legal responsibilities and benefits set out in that contract. If someone is not named in the contract, they can't enforce the contract because it doesn't give them any responsibilities or benefits since they are not specifically mentioned in it.

We've seen this concept trip up even the savviest business owners. In this article, we are going to go deep to examine how this applies to commercial general liability (CGL) insurance and why it’s an important concept to understand when reviewing third party insurance coverage. If you don’t accurately evaluate the policy’s risk transfer endorsements for contract privity, you may unknowingly accept vendor, subcontractor, or tenant insurance that does not properly include your company or relevant entities.

When two businesses decide to collaborate on a project, or one business offers a product or service to another, a contract is created to indicate obligations, liabilities, and certain rights each party carries within the relationship.

Offeror: The party that creates the contract; proposes terms and conditions.

Offeree: The party that the contract offer is made to; may accept the contract, reject the contract, or offer a counter in terms and conditions.

Primary Parties: Comprised of the offeror and offeree, listed as the designated individuals, companies, or organizations that sign a legally binding agreement with set terms and conditions; with written implications.

Third Parties: Any parties who are not bound by the contract but are affected by the contract.

Let’s create a common scenario that we saw often in real life. We’ll use this scenario throughout the article to illustrate the concepts we’re going to cover.

A property owner hires a general contractor (GC) to perform work on their property. The GC then proceeds to hire a subcontractor to perform a portion of the work and creates a contract that the subcontractor must abide by. The GC (offeror) and subcontractor (offeree) are primary parties within the contract. The property owner is a third party.

Part of a properly written and executed contract relates to insurance requirements that one or both parties must abide by. Additional Insured status is often one of the items outlined within the insurance requirements section of a given contract.

An Additional Insured is a person or organization who is added to another person’s or organization’s insurance policy and carries coverage in relation to operations where both the additional insured and the named insured (owner of the policy) are involved. This means that the additional insured is protected by the other person or organization’s policy where they are a listed additional insured.

In our example above, the named insured we’re referring to is the subcontractor. The GC will require that the subcontractor carry insurance in order to work on the jobsite, and the subcontractor will often be required by the contract to include the GC as an Additional Insured on the policy.

It is important to understand contract privity in relation to an additional insured. A contract between two parties often requires that the upstream party (the GC in our example) be granted additional insured status on the downstream party’s (the subcontractor in our example) insurance policy. An additional insured endorsement form can be added to the subcontractor’s insurance policy to fulfill this requirement.

However, not all additional insured forms provide coverage for third parties (such as the property owner) associated with the contract. Instead, some only provide coverage to the primary parties of the contract.

When additional insured status only provides coverage for the primary parties associated within a contract, then contract privity exists.

When additional insured status can apply to primary parties PLUS third parties associated with the contract, then contract privity does not exist.

As with any legal document, there can be many variations. For our purposes here, we will focus on common language found on a typical additional insured endorsement form, such as Insurance Services Office (ISO) standard form CG 20 38 04 13 (and it’s more recent edition, CG 20 38 12 19). This form has the following language:

However, the previous section’s language continues with:

This language extends the additional insured coverage to all other third parties included in the related contract or agreement if they are outlined and required to be included as an additional insured.

Returning to our example, if the GC signifies in the contract with the subcontractor that the property owner must also be listed as an additional insured, then a contract privity limitation cannot exist within the additional insured endorsement on the subcontractor’s policy.

A party associated with the business relationship needs to understand in what scenarios additional insured coverage can trigger. If third parties to the contract are affected by an occurrence or incident, contract privity may get in the way of the third party obtaining coverage to be made whole again. This potentially greatly narrows the amount of coverage an additional insured endorsement provides.

In our earlier scenario, if paragraph 2. of the form we discussed above were missing, the property owner could be exposed to significant liability if an incident occurred on the property. Therefore, it is critical for the GC to verify that the subcontractor’s policy either has the proper language (paragraph 2.) or includes the property owner in the Additional Insured schedule (found on ISO standard form CG 20 10 04 13) to cover the property owner outside of the policy’s privity.

Let’s dig a little deeper into the forms you may encounter. When it comes to contract privity, standard forms vary, but not directly based on contract privity vs no contract privity.

Standard ISO additional insured endorsements fall into two categories:

For this section, we’ll look at these forms in relation to Ongoing and Completed Operations Additional Insured endorsements. There are many different types of standard Additional Insured forms for different types of companies, relationships, and coverage types, but Ongoing and Completed are among the most common, particularly within our example industry (construction).

When comparing Ongoing and Completed Operations Additional Insured endorsements, you have these buckets:

| Scheduled Ongoing and Completed Operation Endorsements | Automatic Ongoing and Completed Operations Endorsements |

|---|---|

|

|

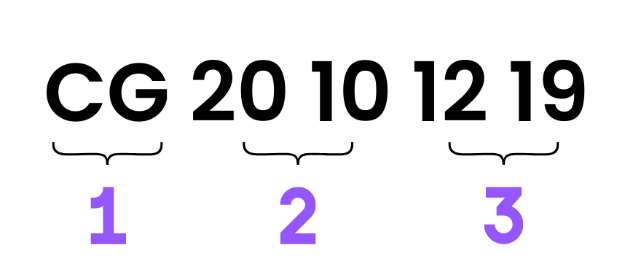

Here’s how to read these form labels:

Believe it or not, there are more different types of forms and edition dates that fall into these categories (state specific, special provisions, etc.). You will want to identify the forms that are relevant to your situation and industry.

When it comes to Ongoing and Completed Operations Additional Insured forms, it is important to understand how contract privity applies. For these types of endorsements, you can categorize the standard ISO General Liability forms into two different buckets – Scheduled Additional Insured forms and Automatic Status Additional Insured forms.

Scheduled Additional Insured Endorsement Forms

Scheduled Additional Insured forms apply only to parties who are outlined within the schedule of the endorsement. The schedule can name a specific company or companies, or it could contain blanket-like wording outlining who can claim additional insured status (wording such as “As required by written contract”).

Scheduled wording on these ISO forms varies and is up to the carrier. That means you need to be careful to break down this scheduled wording to see if additional insured status applies only to the party you signed a contract with, or if it also applies beyond the primary parties (third parties). Ongoing and Completed operation forms that come from ISO with scheduled language start with “CG 20 10” or “CG 20 37”.

Automatic Status Additional Insured Endorsement Forms

Automatic Status Additional Insured Forms do not contain a schedule, but instead outline who is an Additional Insured through pre-determined legal language that does not vary by carrier (these forms already contain blanket-like wording – i.e. Automatic status wording).

Automatic Status Ongoing and Additional Insured endorsements issued through ISO for General Liability whose form numbers start with “CG 20 33” and “CG 20 39” contain language that outlines that primary parties who you have agreed to add as an additional insured through a contract have additional insured status. In other words, contract privity exists in relation to these endorsements because the legal language does not extend to secondary parties.

Example Legal Wording:

Automatic Status Ongoing and Additional Insured endorsements issued through ISO for General Liability whose form numbers start with “CG 20 38” and “CG 20 40” contain language that outlines that primary parties and third parties who require additional insured status that you agree to add as an additional insured through a contract have additional insured status. In other words, contract privity does not exist in relation to these endorsements because the legal language does extend to third parties.

We covered the legal wording of this type of form (CG 20 38 in our example) in the previous section.

Manuscript Forms

Keep in mind that the legal wording we discussed only relates to the standard ISO forms outlined above. Manuscript forms, or forms that are written by carriers, may also be attached to a policy or wording may be found in the main coverage form that does not follow this language.

In these manuscript cases, breaking down the language on these manuscript forms is an important step to analyze the coverage provided as there is no standard wording in these cases. It is also important to note that this analysis over ISO forms is based on court rulings in several states.

Precedence in relation to this wording can be subject to differences in state laws that alter how additional insured status applies based on state interpretation. We explore legal precedence more later in this article.

According to IRMI, in the U.S., there is not consistent precedent nationally as to the impact of contractual privity on additional insured endorsements, and specifically, endorsements such as the one described above. To understand this, let’s take another look at our example and add a small detail.

Let’s assume that the property owner’s contract with the GC requires that the GC and all subcontractors include the property owner as an additional insured on their policies. Now let’s assume that the subcontractor gets the Additional Insured form discussed above, with both paragraphs included.

In some states, such as Connecticut, Maine, and Texas, this is perfectly adequate to ensure that the property owner is covered by the subcontractor’s policy in the event of an occurrence. However, in other states, such as New York, Illinois, and Louisiana, courts have found that contractual privity would be required specifically between the property owner and the subcontractor for the subcontractor’s policy to cover the property owner.

It is important to know the laws and precedent of the states where work is being performed when determining which form and language is appropriate for your situation. Even then, some states have inconsistent precedent, so it may be best to require all parties to be explicitly named on the Additional Insured schedule to ensure coverage is properly extended.

Contract privity is an example of the nuanced legal language that should be reviewed to properly verify third party insurance coverage prior to engagement when necessary. Without understanding this concept, it is easy for minor policy language variations to completely change the scope of coverage.

If you are looking for effective policy reviews that identify subtle language like this, Injala’s Asuretify platform is the perfect solution. Asuretify uses sophisticated artificial intelligence to read policy documents and endorsements to identify both the coverage text and the coverage intent. The system can help you catch critical language like contract privity before it becomes a legal liability.

Learn more about Asuretify and get started for free today at Asuretify.com!

Court Case discussing contract privity language on the additional insured forms:

New York Court of Appeals Finds Privity of Contract Required

to Trigger Additional Insured Coverage - Black Marjieh &

Sanford LLP (bmslegal.com)

More on contract Privity:

Views expressed here do not constitute legal advice. The information contained herein is for general guidance only and not for the purpose of providing legal advice. Discussion of insurance policy language is descriptive only. Every policy has different policy language. Coverage afforded under any insurance policy issued is subject to individual policy terms and conditions. Please refer to your policy for the actual language.